Mindspeed Technologies Inc. is a Fabless Semiconductor Company

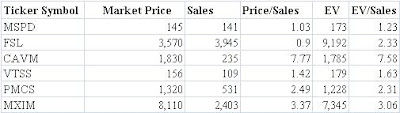

Mindspeed Technolgies is a fabless semiconductor company that is likely to be acquired in the near term at a substantial premium. The company has three product segments; communication convergence processors, high-performance analog, and wireless infrastructure. On April 30th, Mindspeed Technologies announced that they had hired Morgan Stanley to evaluate strategic alternatives. Mindspeed Technologies is a leading global provider of network infrastructure semiconductor solutions. They could be very valuable to a big name player. For acquisition purposes and considering this is in an industry with a high growth outlook, I looked at Mindspeed in comparison to its peers based on Price/Sales and EV/Sales (all numbers in millions). Based on its peers the average Price/Sales Multiple is 3.19 and the average EV/Sales multiple is 3.38. These multiples applied to MSPD would mean a Market Price of $450 million (north of $10/share) or an Enterprise V...