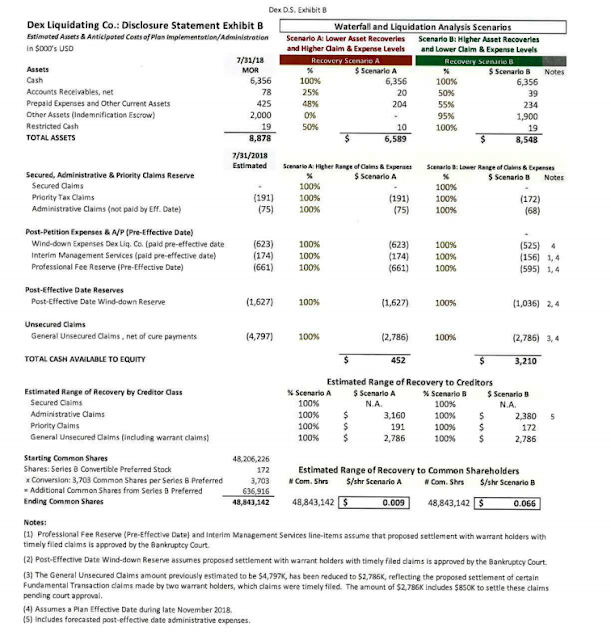

Today an amended Plan of Liquidation along with a Stipulation regarding the settlement between the Warrant Holders was filed. The settlement includes among other things: The SHMF Claim shall be reduced, and allowed as a general unsecured claim in the total amount of $283,333.33 (the “Allowed SHMF Claim”), with prejudice to SHMF’s ability to amend the Allowed SHMF Claim or file further claims against the Debtor or its estate. The SVWMF Claim shall be reduced, and allowed as a general unsecured claim in the total amount of $141,666.67 (the “Allowed SVWMF Claim,” collectively with the Allowed SHMF Claims as, the “Allowed Sabby Entities Claims”), with prejudice to SVWMF’s ability to amend the Allowed SVWMF Claim or file further claims against the Debtor or its estate. The Alpha Claim shall be reduced, and allowed as a general unsecured claim in the total amount of $425,000.00 (the “Allowed Alpha Claim”), with prejudice to Alpha’s ability to amend the Allowed Alpha Clai...